GST (Goods and Services Tax) is added in more goods and services, it is an indirect tax and successor to VAT used in India on the supply of goods and services. The GST Act was passed in the Parliament on 29th March 2017 and came into effect on 1st July 2017. GST Law in India is a comprehensive, multi-stage, destination-based tax that is applied on every value addition.

What is the Eligibility Criteria for GST Registration?

The following categories and eligibility for GST registration in India:

Aggregate Turnover

Any service provider who has more than Rs. 20 lakhs Aggregate Turnover is eligible for GST registration. In the special category states, this limit is Rs. 10 Lakhs. Any entity who is engaged in supply of Goods and has more than Rs. 20 Lakhs turnover is also required to obtain GST registration.

Inter-state Business

Any entity who supplies Goods and services from one state to another, and has more than Rs. 40 lakhs in one year is eligible for GST registration (in special category states, the limit is Rs. 10 lakhs).

E-commerce Platform

Any individual who supplies Goods and Services is also eligible for GST registration. Hence, sellers on Flipkart, and other e-commerce platforms must obtain registration to commence activity.

Casual Taxable Persons

Any individual who supplies Goods and Services seasonally through a temporary stall or shop must apply for GST.

Voluntary Registration

Any business can register for Voluntary GST registration. Earlier, any business who registered for Voluntary Registration won’t be able to surrender from registration for up to one year. However, after revisions, voluntary GST registration can be surrendered by the applicant at any time.

Types of GST Registration

Normal Taxpayer

This type of registration only applies to those who run a business in India. Taxpayers who apply for Normal Taxpayer doesn’t require any deposit and are also provided with an unlimited validity date.

Composition Taxpayer

To register for Composition Taxpayer, the individual should enrol under the GST Composition Scheme. Taxpayers who enrolled under the Composition Scheme can pay a flat GST rate. However, the taxpayer would not be permitted to claim the input tax credit.

Casual Taxable Person

An individual who starts a seasonal shop should register for Casual Taxable Person. For a Casual Taxable Person, the taxpayer is required to pay a deposit equal to the amount of GST liability. The registration remains active for 3 months.

Non-Resident Taxable Person

Individuals or Businesses who supply Goods and Services from outside of India, can apply for Non-Resident GST Registration. To register as a non-resident GST Registration, the taxpayer needs to pay a deposit equal to the amount of GST liability.

Also read about: How to track my GST Payment Status

What do I need to Register?

The following is a list of required documents for your registration.

| Lists | |

| Proof of Constitution of Business | Certificate of Incorporation |

| Passport size photo of the applicant | Passport size photo of Promoter/Partner |

| Photo of the Authorized Signatory | Photo |

| Proof of Appointment of Authorised Signatory | Letter of Authorisation |

| Copy of Resolution passed by BoD/ Managing Committee, and Acceptance letter | |

| Proof of Principal Place of business | Electricity Bill |

| Legal ownership document | |

| Municipal Khata Copy | |

| Property Tax Receipt | |

| Proof of Details of Bank Accounts | The first page of Pass Book |

| Bank Statement | |

| Cancelled Cheque |

Advantages of GST Registration

Here are some Advantages of GST Registration.

- Tax is accounted for in a uniform manner.

- Your business will be able to avail all the benefits that come under the GST rule.

- Your business will be recognised legally.

GST Registration Exemption

The mentioned businesses are exempt from GST registration:

- Agriculturists.

- Businesses that manufacture supplies that come under reverse charge.

- Businesses that make exempt/ nil-rated supplies.

How to Register for GST in India

The MoF (Ministry of Finance) has simplified the GST registration process. The applicant can easily register for GST by using the GST Portal, and get GST ARN (Application reference number) immediately. Using ARN, the applicant can check the status of Application and post queries if necessary.

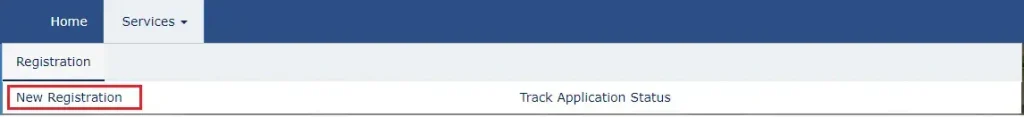

1. GST Portal

- Go to the GST Portal.

- Tap on the Services.

- And click on “New Registration”.

For Calculate Indian GST Please visit out India GST Calculator

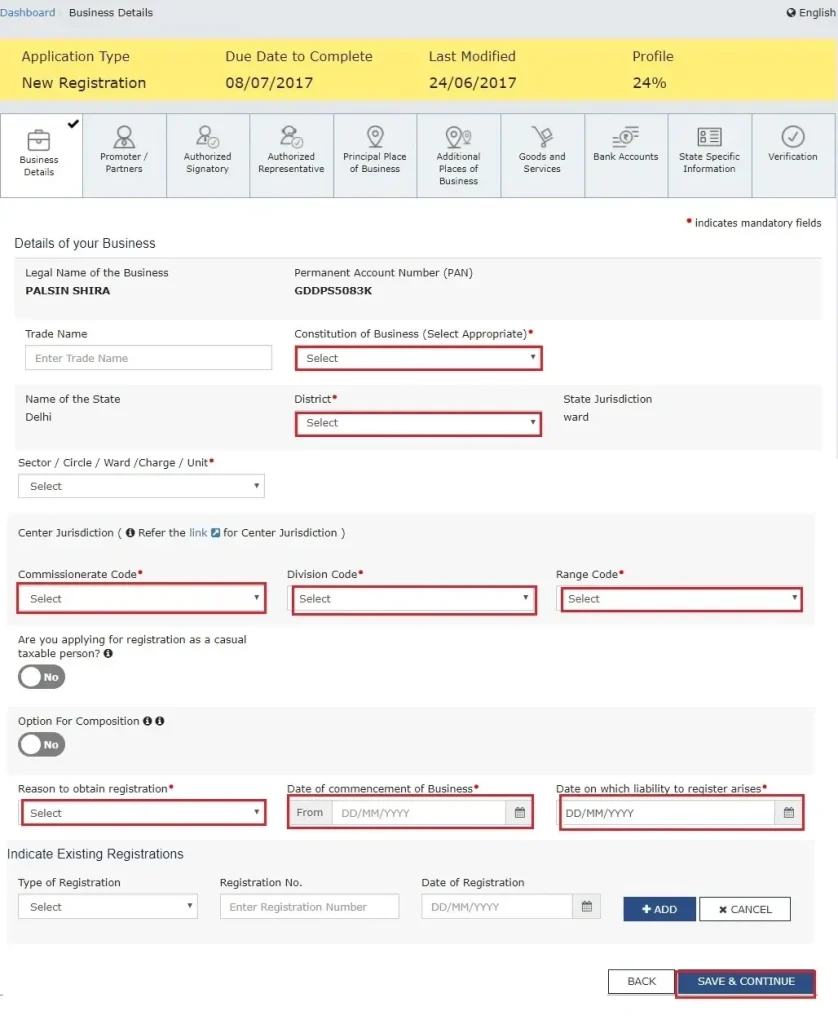

2. Fill the Form

- See the ‘I am a’ drop-down menu, and select ‘Taxpayer’.

- Select the respective State & district.

- Provide your Business Name.

- Enter Business PAN Number.

- Provide your Email and Phone Number.

- Click on the Proceed

3. OTP Verification

Once you click on the Proceed button you’ll receive OTPs on your Email and Phone number, just enter in the respective boxes and Click on ‘Proceed’.

4. TRN Generated

After verification of OTP, you see TRN (Temporary Reference Number) on the screen. Make a note of the TRN (Temporary Reference Number).

5. Log in with TRN

After receiving TRN

- Go to the GST Portal again.

- Enter TRN number and the captcha details.

- Click on the Proceed Button.

- You’ll receive OTPs on your Email and Phone number.

- Enter and Click on the Proceed button.

6. Submit Business Information

Various Information is required for registration for GST.

7. Submit Promoter Information

In the next tab, provide the promoter and directors information.

8. Submit Authorized Signatory Information

An authorized signatory is the person who is nominated by the company. The nominated person has the responsibility for filing GST returns of the company. The signatory person has full access to the GST Portal.

9. Principal Place of Business

In this section, the applicant provides the details of Principal places of the Business. The Principal Place acts as a primary place of the business.

10. Additional Place of Business

In this section enter the additional places of business, for example if the applicant is a seller on Flipkart or other e-commerce portal and uses the seller’s warehouse, the location can be added in this section.

11. Details of Goods and Services

In this applicant provides the top 5 Goods and Services supplied by the applicant. For goods supplied, provide the HSN code and for services, provide SAC code.

12. Details of Bank Account

In this section, The applicant enters the Bank accounts details like account number, IFSC code, type of account, and upload a copy of the bank statement or passbook in the place provided.

13. Verification of Application

Verify all details in form, once verified click on the verification box. Finally, digitally sign the application using Digital Signature Certificate (DSC)/ E-Signature or EVC. Digitally signing using DSC is mandatory in case of LLP and Companies.

FAQs

1: Is GST registration free?

Yes, GST registration is free in India. But not everyone is required to register for GST. The business who has more than Rs. 40 lakhs turnover in 1 Year, is required to register for GST.

2: What is the deadline for registering under GST?

If the business is required to register for GST must apply for registration within 30 Days.

3: What if the GST application is rejected?

If your GST application was rejected. You’ll be given a chance to respond to the rejection letter. However, if you desire to reapply, you’ll wait for the final rejection.

4: Is a bank account mandatory for GST registration?

No, the bank account is not mandatory for the time of GST Registration.

5: Can I surrender my GST number?

Yes, you can but after one year of registration date.

Conclusion

GST is tax on more Goods and Services supplied in India by registered businesses. To register for GST your turnover must be more than Rs.40 lakh (or Rs.20 lakh in the northeastern and hill states). To register for GST please read the our above instructions. After registration you’re eligible to add a GST number in your Goods and Services price.