GST (Goods and Services Tax) is added in more goods and services. If your earning is more than $60,000 in 12 months, You may need to register for GST. You can claim back the GST you buy for your Business. You charge 15% GST on what you sell — this is collecting it on the government’s behalf.

What is GST?

GST (Goods and Services Tax) is a tax added to the price, including imports. GST (Goods and Services Tax) also known as Value Added Tax (VAT). France was the first nation to implement the GST in 1954 in Ivory Coast (Côte d’Ivoire) colony. It is levied on the Goods and Services at each stage of production, or sale to the end consumer. The amount of GST decided by the state as a percentage of the price of the goods.

In New Zealand GST was introduced by the Fourth Labour Government of New Zealand on 1 October 1986 at a rate of 10% on most goods, it replaced existing sales tax. Since it was introduced, there have been two increases in rate one is on 1 July 1989 the rate increased to 12.5% and second on 1 October 2010 it increased again to 15%.

Who needs to register for GST?

Not every business needs to register for GST. If you earn more than $60,000 in a year, you may need to register. You may be an exception, if you’re selling exceptional services. You may face a penalty if you don’t register for GST (and collect) when you should.

For Calculate your GST tax, Visit our New Zealand GST Calculator

What do I need to register?

To register for GST you’ll need

- An IR number and a myIR online account.

- A BIC (Business Identification code).

- Your Business bank account details.

Choosing your filing frequency

During the registration process, you’ll be asked how to return a GST file, and how your account for GST. There are three types, but they may not all be available for you.

Also read about: New Zealand Income Tax Rate

- Monthly: Businesses with more than $24 million threshold in 12 months must file monthly.

- Two-monthly: Small businesses are expected to file every couple of months.

- Six-monthly: You can drop to twice-a-year returns if your annual threshold is less than $500,000.

The IRD (Inland Revenue Department) puts you on two-monthly filing by default unless you choose otherwise.

Should I choose Payment basis, Invoice basis or Hybrid basis for GST?

The account basis determines when you owe GST. There are three options, but they may not all be available for you.

- Payments basis: You owe for GST when you receive an amount from the consumer.

- Invoice basis: You owe for GST when you raise an invoice.

- Hybrid basis: This method is a cross between the payment and invoice options. It uses the account basis to owe for GST, and it uses the payments basis to account for your purchases. It can get complicated.

Also read about: Taxes in New Zealand

How to register for GST in New Zealand

You can easily register for GST by using the online IRD Portal. To register for GST please follow the below steps, and if you get stuck, call the IRD helpline for business – 0800 377 774.

- Go to the IRD portal, before registration you’ll need

- An IRD number.

- Bank account number, GST funds can be paid to you.

- Income figures (Your turnover in the last 12 months).

- BIC (Business Identification code).

- To have made a decision about the return filing.

- To have made a decision about the payment basis, invoice basis or hybrid basis for GST.

- Login into IRD, you are doing this for the first time. You’ll need to click on the ‘not yet registered’ button and follow the instructions.

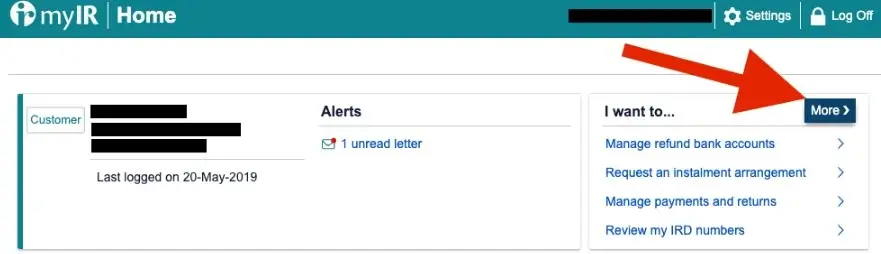

- See the right corner at the ‘I want to’ menu, click on the More> button to register as a new registration.

- Click on the ‘Register for new tax accounts’.

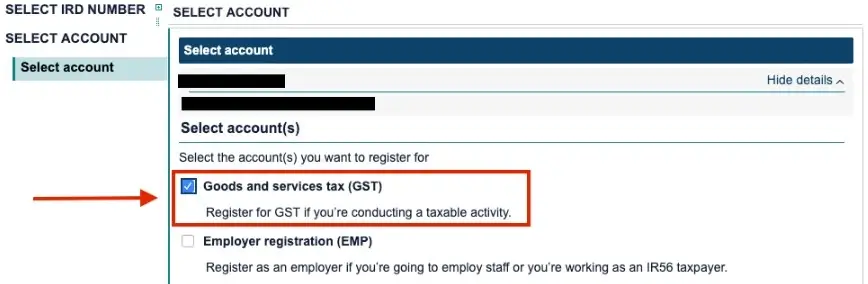

- Add or select your IRD number, and click next.

- Tick on the Goods and Services Tax (GST) and Confirm.

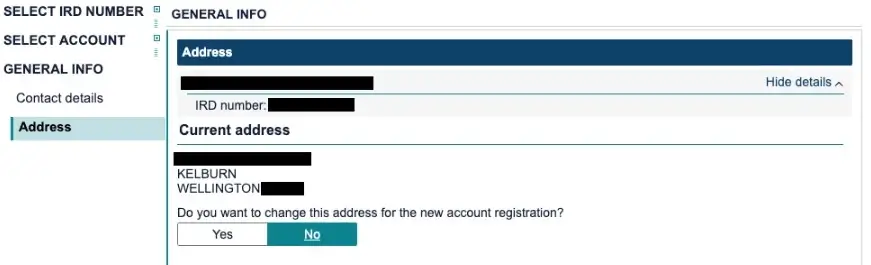

- Edit or provide your address, bank account details, and contact info.

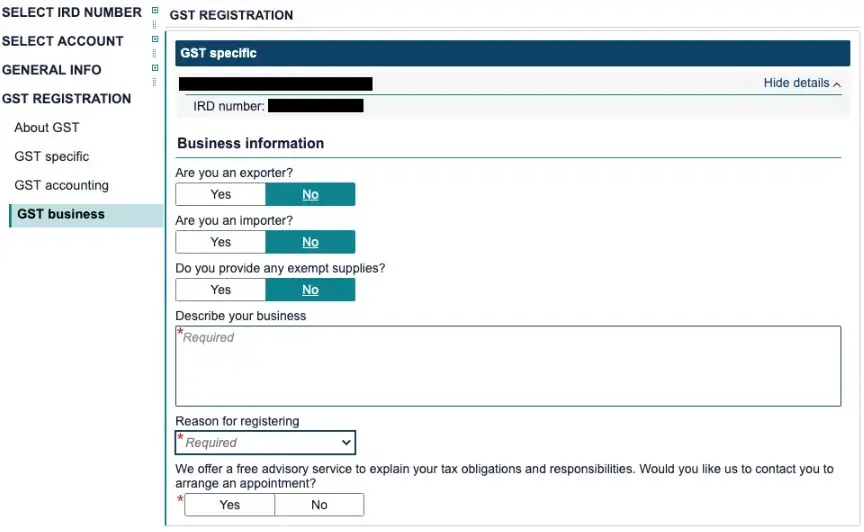

- Enter your Business Identification Code (BIC), this is important because it determines your ACC levies. Click on the ‘ find my BIC code’ button if you don’t know your industry’s code.

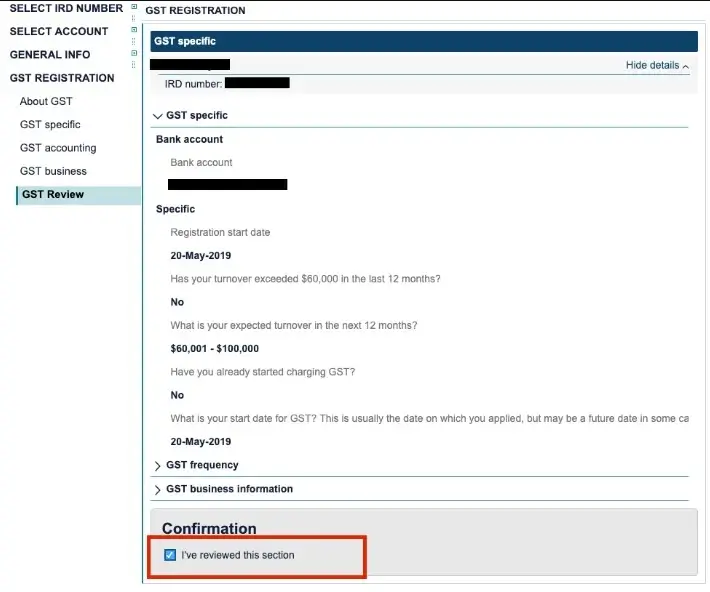

- Check all your information, if the information is correct, tick the box for ‘I’ve reviewed this information’ and hit the next button.

- Read the next page carefully, because it explains the rules of GST, if you agree click on Yes.

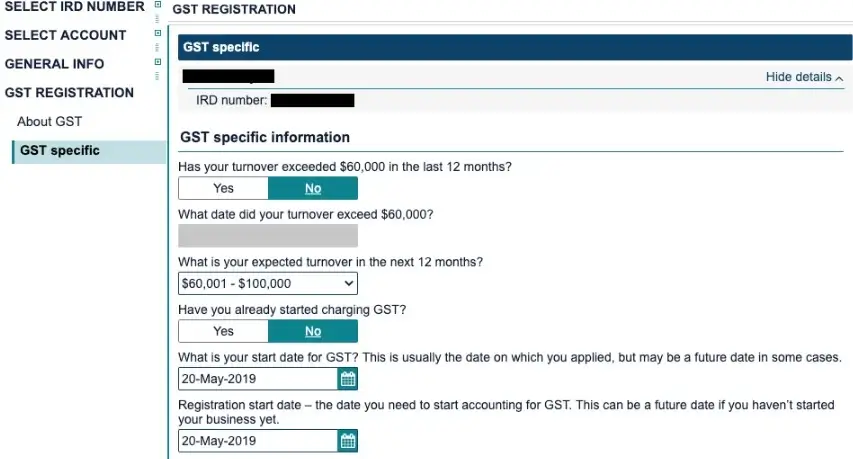

- Next you’ll give some answer, about your current and predicted threshold. You also have to provide a start date for GST and a registration start date. Then you’ll select the filing frequency and accounting basis.

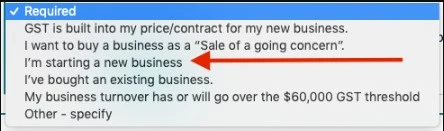

- Then you’ll also provide some answers about the nature of your work. If you’re new to self-employed then select ‘I’m starting a new business’ answer. But if you’re already self-employed and need to register for GST then select the answer that says, ‘My business has or will go over the $60,000 GST threshold’.

- Finally, take a minute and review your answers to reconfirm and submit your registration.

And then what happens?

This process can take a few days to take action on your registration. Be patient, after your registration, you must add GST in your sales, also add a GST number in your invoice. After you start charging GST, you need to commit to:

- Keeping GST records.

- Filing GST returns on time.

- Paying any GST you owe IRD on time.

FAQs

1: Who needs to register for GST NZ?

Whether you are a business person, sole trader, or in a partnership with a company , you need to register for GST as soon as possible after your threshold is more than $60,000 in 12 months.

2: How long does it take to get a GST number NZ?

This process will take 10 working days, and if the Govt. Tax office needs more information so they will contact you. Your GST account will show in myIR once your registration is confirmed. Your GST number will be the same as your IRD number.

3: Who is exempt from GST?

Some Goods and services are exempt from GST like Financial services, human blood, residential rent, and donated goods sold by non-profits fall into this category.

4: Who pays GST?

GST is paid by consumers, but the amount will be remitted to the Government by the sellers. GST also known as Value added Tax (VAT). In New zealand the current rate of GST is 15%. It means every registered GST seller charges 15% GST on goods and services prices.

Conclusion

GST is a tax on most Goods and services supplied in New Zealand by Registered sellers. To register for GST, you must have $60,000 turnover in 12 months. To register for GST please read the above instructions. After registration you must charge GST, also add a GST number in your invoice.