Singapore GST Calculator

Singapore GST Calculator

In Singapore, 8% GST (Goods and Services tax) was introduced in 1994. It increased by 8% on 1st January 2023. The value added tax applies on all services, and products. Exports of goods and international goods are zero-rated.

How to use the Singapore GST Calculator?

We’ve predefined a button on the Singapore GST Calculator. You just have the value to calculate GST. All GST calculations will be updated automatically.

- The amount of GST in “Add GST” is the GST inclusive price.

- The amount of GST in “Subtract GST” is the GST exclusive price.

Also, visit Indonesia VAT Calculator

How to calculate GST in Singapore?

To calculate Singaporean GST (Goods and Services tax) at 8% rate. Simply multiply your GST exclusive amount by 0.08.

- $10 is a GST exclusive value.

- $10 * 0.08 = $0.8 GST Amount.

To get the GST inclusive amount, simply multiply your GST exclusive amount by 1.08.

- $10 is a GST exclusive value.

- 10*1.08 = $10.8 GST inclusive amount.

To get the GST Tax amount, just divide the GST inclusive amount by 108 and multiply by 8.

- $10 is a GST inclusive value.

- ($10/108) * 8 = $0.72 GST value.

To get the GST exclusive amount, simply the GST inclusive value multiply the GST inclusive price by 100 and then divide the result by 108.

- $10 is a GST inclusive value.

- $10 * 100 = $1000.

- $1000/108 = $9.3.

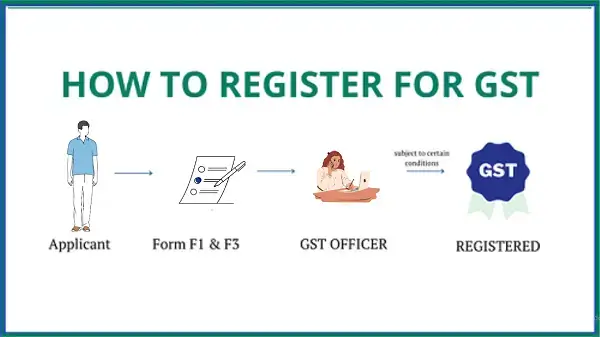

How to Register for GST Singapore?

You can register yourself by using the online myTax Portal.

Do I Need to Register for GST?

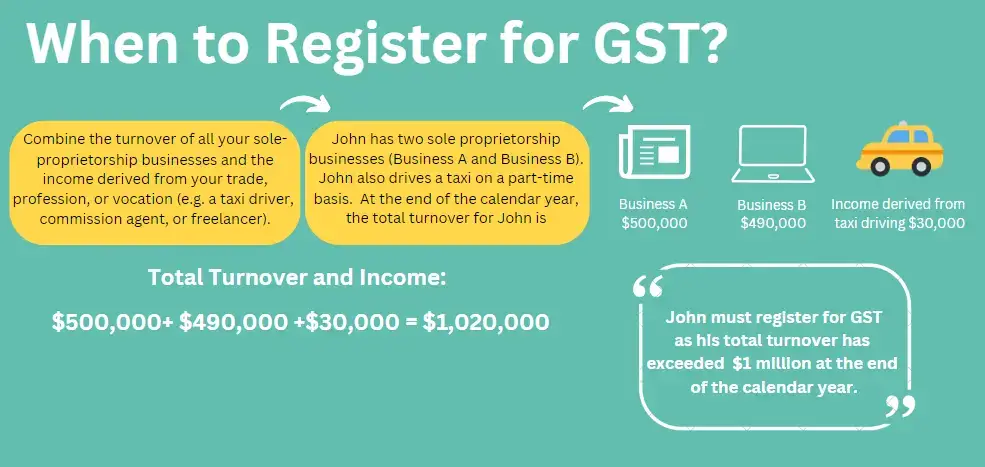

You must register for GST, if your turnover is:

Late liability for GST Registration

- Your date of GST registration will be backdated to the date when you’re liable for registration.

- You’ll have an account for GST pay, for your past sales. Even if you do not collect the GST from customers.

- You may face a penalty of $10,000.

GST on Imports Goods and Services in Singapore

To import Goods and Services in Singapore is required to make a declaration to Singapore customs. Both GST (Goods and Services Tax) and duty is payable for dutiable goods if these goods are imported for local consumption.

GST on Exports Goods and Services from Singapore

Goods exported from Singapore are regulated under the Customs Act. To export Goods and Services is required to declare to Singapore customs. GST is not levied on exported Goods and Services from Singapore.

Tourist GST Refund Scheme in Singapore

The TRS (Tourist Refund Scheme) is administered by Singapore Customs on behalf of the IRAS (Inland Revenue Authority of Singapore). This scheme permits tourists to refund GST paid on goods purchased from participating retailers if the goods are brought out of Singapore via Seletar Airport or Changi International Airport.

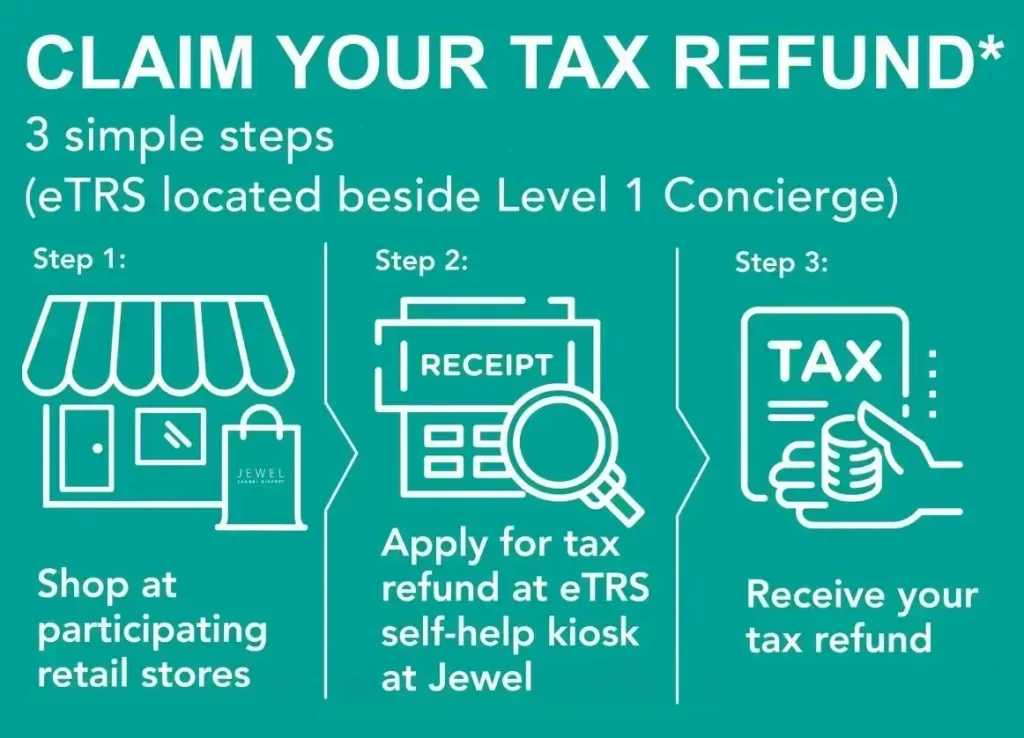

How do I get my Tax refund?

There several ways to get refund Tax:

Via the Electronic Tourist Refund (eTRS) self-help kiosks at the airport

Apply refund for GST using eTRS self-help kiosks at Airport Departure Check-in Hall (before departure immigration). You’ll arrive at the airport as early as sufficient time for refunding Tax.

Scan your Passport at the kiosk to retrieve details of all your purchases, and follow the instructions to apply for a GST refund. After done, read the outcome shown on the kiosk to confirm. If you would need to go to the Customs Inspection counter to have your purchases verified.

Via Global Blue or Tourego Mobile Applications (App)

For ease to refund TAX and track of your all purchases, use eTRS mobile applications provided by Global Blue and Tourego. It is important, when you want to refund GST using your Mobile Application, please ensure that you have turned on your location service and notification alert on your mobile phone. Make sure to be within 15m radius of the eTRS Self Help kiosks at the airport.

Different modes of Refund GST in SG

Cash Refund

Please head to the Central Refund Counter in the Departure Transit Lounge with your passport. The cash is not available if you depart from Seletar airport.

Credit Card

After your claims at the eTRS kiosk. The money will transfer to your credit card within 10 Days upon successful claim submission.

GST Refunds are not allowed on

- Goods which are wholly or partly consumed in Singapore.

- Goods exported by freight.

- Goods not presented for inspection.

- Accommodation in hotel, hostel, boarding house or similar establishments.

- Services like car rental, entertainment, dry cleaning, etc.

Eligibility of Refund GST

As a tourist in Singapore, if you purchase goods more than $100 (including GST) at participating shops. You can claim a refund on the 8& GST paid. This is known as the Tourist Refund scheme.

Conclusion

In this article, you how to calculate SG GST, registration steps of GST. If you want to register for GST, your turnover must be more than $1 Million. You can also register online using myTax Portal. To refund GST use Global Blue or Tourego Mobile Applications which are easy to use.