GST (Goods and Services Tax) is an indirect tax paid by registered traders / dealers for the supply of goods and services. Many of them are facing an issue in tracking their GST payment status so, here you’ll learn how to solve it.

Steps to track the GST payment status online

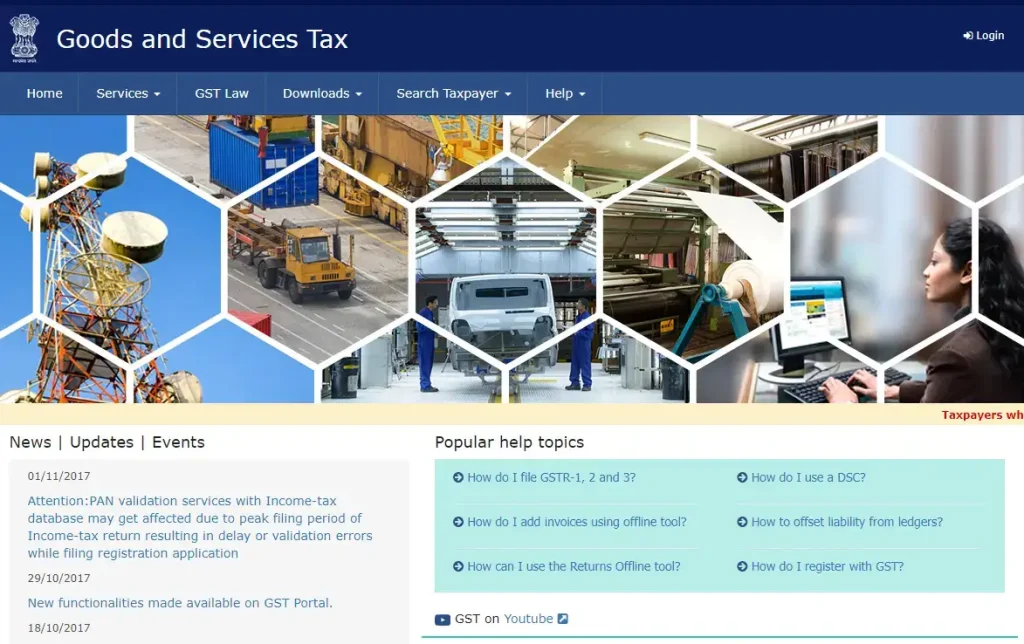

Step 1

Go to the official GST portal, on the Dashboard go to Services tab>>Payments>>Track Payment Status. In order to check payment status, you’re not required to login.

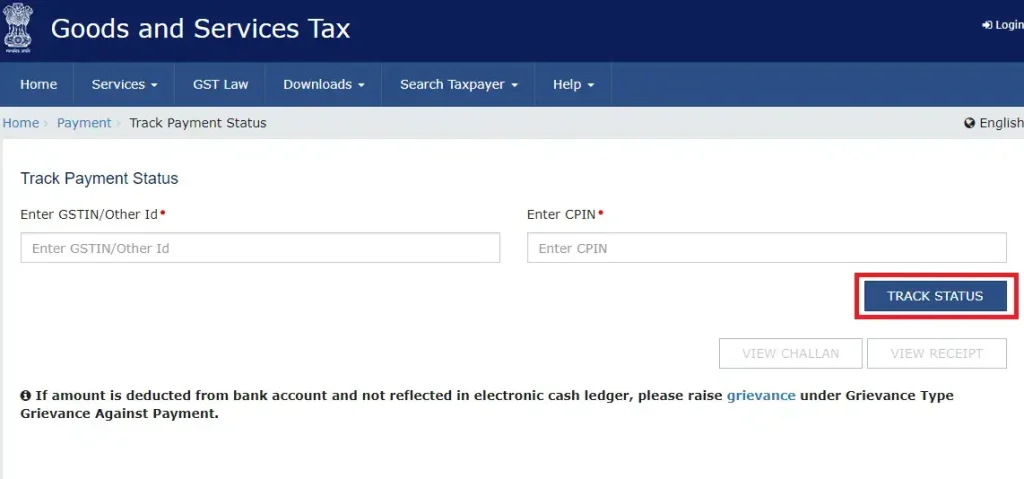

Step 2

Enter your CPIN and GSTIN, to check your GST Payment status.

For GST calculation you may visit our India GST Calculator

Step: 3.A

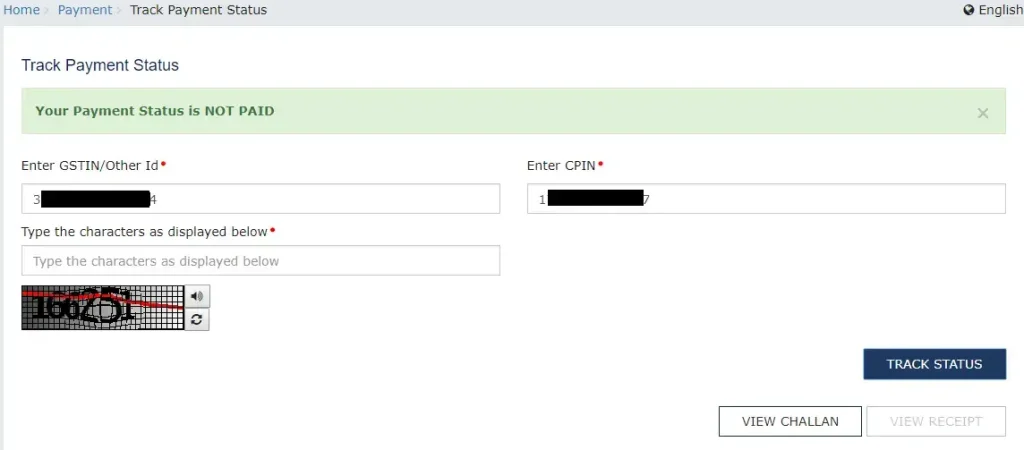

When the status shows “Not Paid,” click the download button to save offline.

The status shown on the screen is either Paid or Not Paid.

Step: 3.a

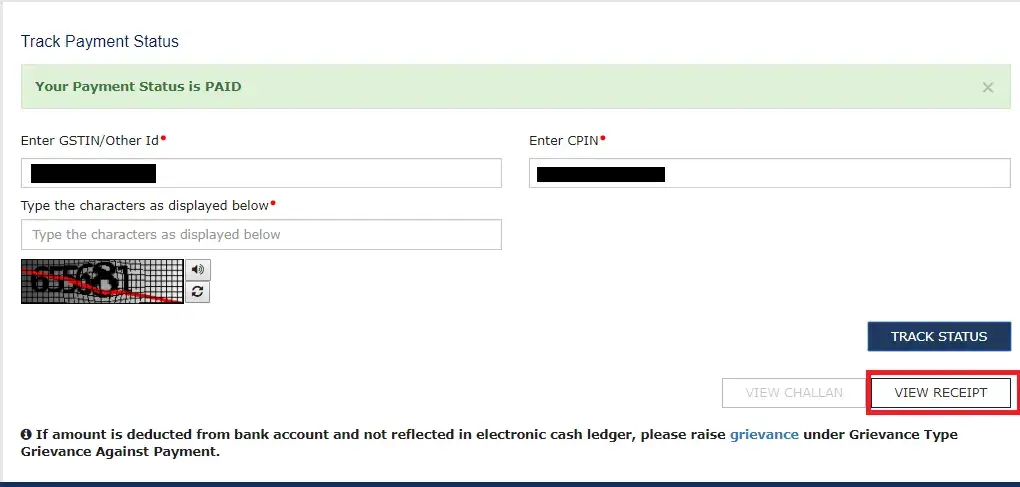

When the status shows “Paid.”

Step: 3.b

If it is showing as paid, click on the “View Recipient” and Download.

Step: 3.B

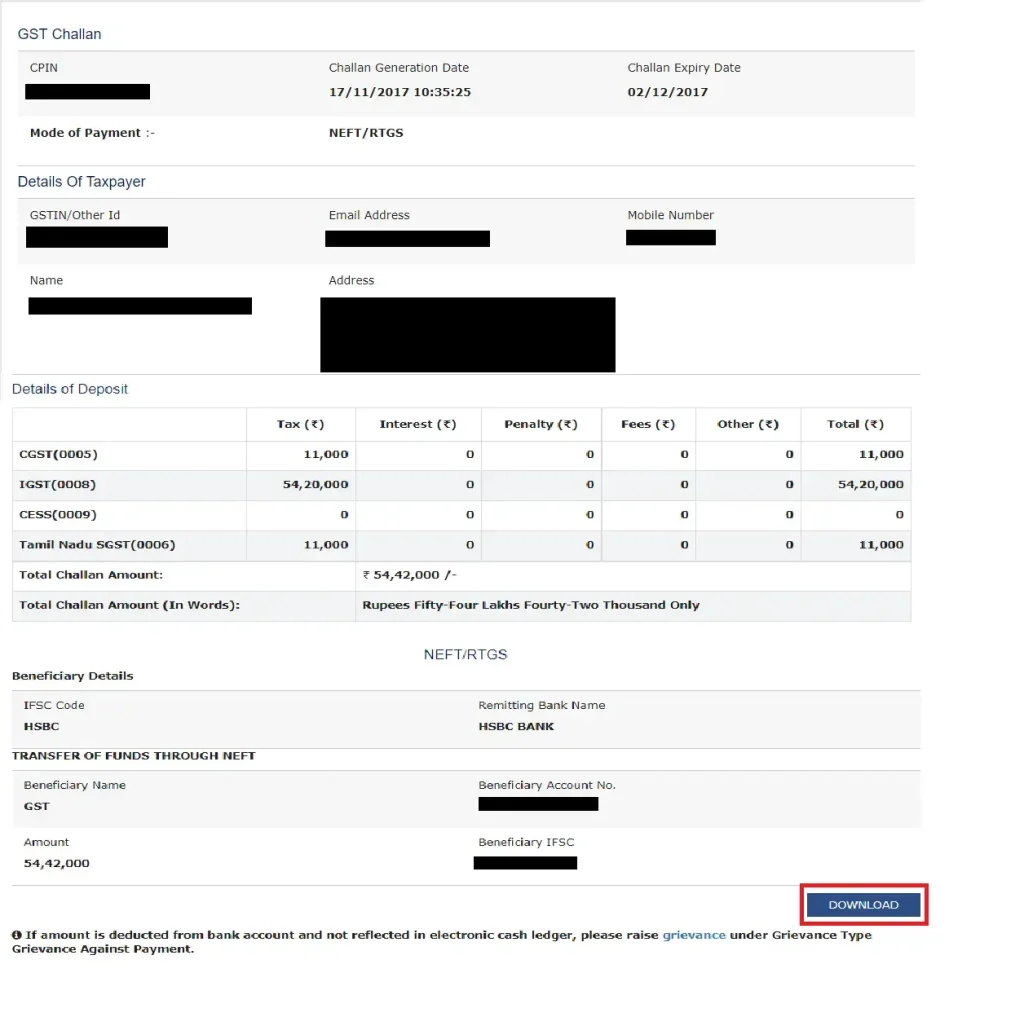

If you want to see the challan, simply click on the “View Challan” The challan will open as below. You can save an offline copy by clicking “Download.”

FAQs