Lodging a tax Return in New Zealand | Guide 2024

If you’re earning in New Zealand, you’ve to pay tax on different Goods and Services. Taxes help the country to make public infrastructure, economic growth, social Welfare, and more. Well did you know you can claim back tax refund? Of course here you’ll learn how to lodge a tax return in New Zealand.

What is Lodging a Tax Return in New Zealand?

Lodging a tax return is the process of submitting your comprehensive financial information, and relevant documents to the IRD (Inland Revenue Department). It is required for individuals, businesses, trusts and other entities to report their income, tax credit, and other financial relevant transactions.

It is important to note that lodging a tax return in New Zealand is not a one time event. It is an annual process starting from 1 April to 31st March. By lodging a tax return on time, taxpayers fulfil their legal obligations, and ensure that they are paying the appropriate amount of tax or receiving any entitled refunds.

You may visit out Online GST Calculator for calculate your GST.

You Might Get Your Tax Refund Automatically

As per update of 2019, The IRD (Inland Revenue Department) will automatically refund tax of most taxpayers who have worked each financial year (which begins on 1 April and ends on 31 March).

Who Gets an Automatic Tax Return in New Zealand?

You’ll get your Tax Return if your income is

- Employment.

- Investments (such as interest or dividends under NZ$200)

- An employee share-scheme benefit where tax is already deducted.

- Schedular payments.

- Income-tested benefits.

- Taxable Māori authority distributions.

- New Zealand superannuation (NZ Super).

If you’ve earned somewhere else listed above, you may complete an Individual Tax Return Form (IR3).

Make Your “myIR Account” Details are Up to Date

Most taxpayers get their Tax Return automatically, it is essential to make your myIR account up to date. Most importantly your contact information (Phone number, Email, and home address) and the bank account details.

Can overseas Lodging a Tax Return file in New Zealand?

Yes, overseas taxpayers are also able to lodge a tax return file. Update your address on your myIR Account to your current overseas address. Then, you’ll be able to change your bank account details to an overseas bank account.

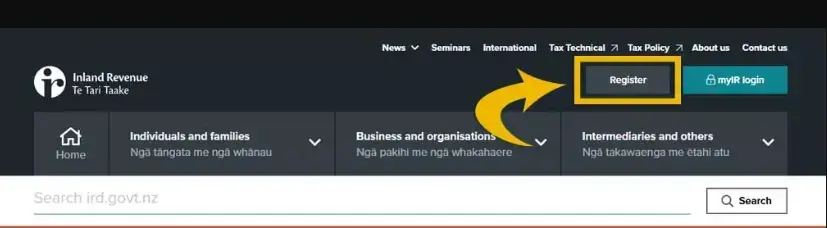

How to Register with IRD Online?

Don’t have an IRD (Inland Revenue Department) account, follow these steps to register your IRD account so you’re able to lodge a tax return in New Zealand:

1. Register for a myIR Account:

To register for myIR account go to https://www.ird.govt.nz/ homepage and click on the register button. If you’ve registered myIR account, skip the steps to 7th.

2. Enter Your IRD Number

When you click on the register button, this will take you to the introduction page of myIRD so you just need to click next.

Under Personal Details make sure you’ve selected the IRD number, then enter your IRD number (don’t need to select hyphens as they appear automatically). You can find your IRD number on any pay slips you received or you can also see How to Apply for an IRD number.

Then enter all your details (first name, last name, date of birth). Once all of the fields are completed, click on the “I’m not a robot” checkbox and then click “Next“.

3. Fill in Your Email Details

On this page you’ll need to choose username, password, provide Email address and provide phone number with appropriate dial code.

Note: This image is from an old IRD website. When you see the website it may look different.

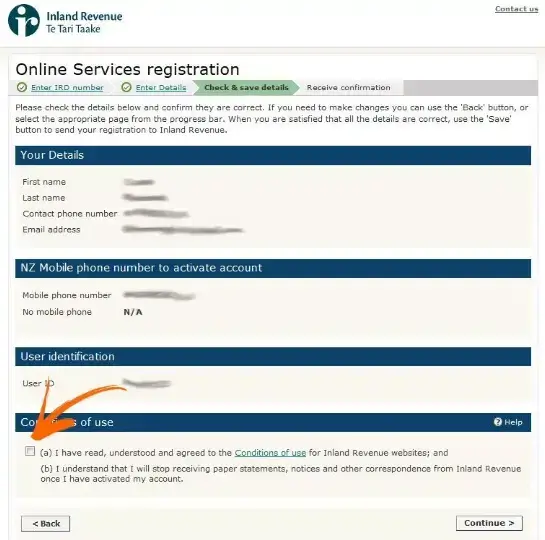

4. Agree to the Conditions of Use

Check your all details, and make sure you’ve entered the correct details and click on the agree button to continue the process.

Note: This image is from an old IRD website. When you see the website it may look different.

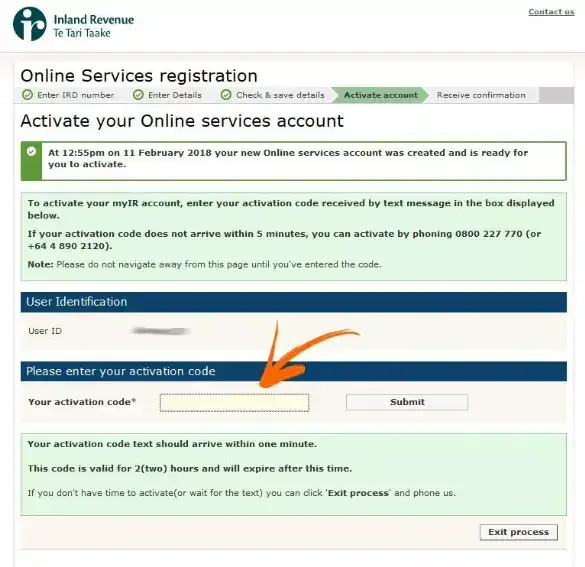

5. Activation Code

Now you’ll receive an activation code, you’ve 2 hours to enter this code otherwise click on the “Exist Process”.The call to IRD (Inland Revenue Department) for an activation code. Enter the activation code and click “submit“.

Note: This image is from an old IRD website. When you see the website it may look different.

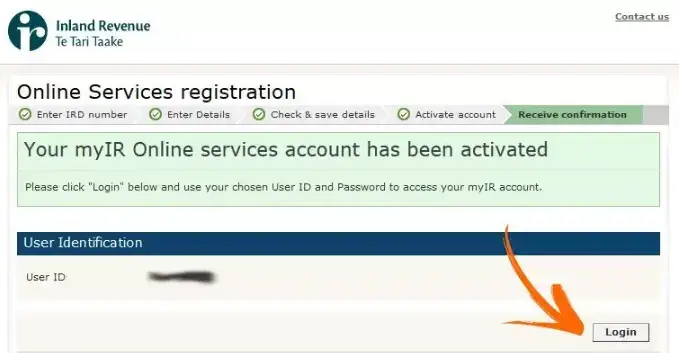

6. Login Into Inland Revenue Online Services

If you successfully submit your activation code, then click on the “login” button.

Note: This image is from an old IRD website. When you see the website it may look different.

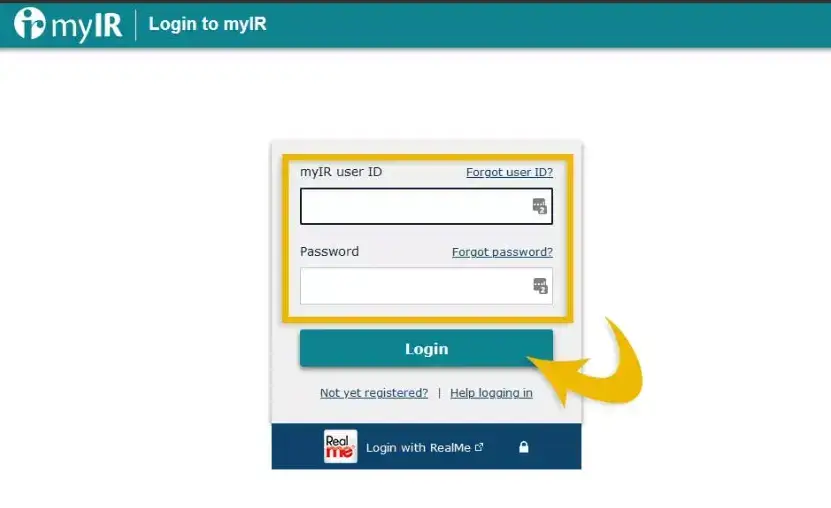

7. Log into myIR

Enter your username and password that you’ve created in your previous step and click the login button.

Well you’ve created your myIR account, now lodging a tax return in New Zealand now becomes more simple. Now make sure your tax return comes through at the end of the financial year to update your bank account details.

8. How to Change Your Address and Bank Account Details?

Now, change the bank account details so that the return tax comes to the right bank. First click on the “I want to …” and then click on “Manage names and addresses” after correcting the address click on the “Manage Refund Bank Accounts” from the country of your state for refund to be paid into.

Alternative Ways to lodging a Tax Return in New Zealand

If you can’t file a tax return online, for whatever reason, then you can also complete the Individual Tax Return Form (IR3) manually via the IRD website.

You are Eligible for a Tax Return But Didn’t Receive One

The best way to contact them directly, to login to your myIR account, and click on the “I want to…”, then under “Communicating with IR ” select “Send a message”.

You can contact them with the following details:

- +64 3 951 2020 (overseas).

- 0800 227 774 (New Zealand).

- You can get a nominated person to contact IRD on 0800 227 774 by sending IRD a completed Elect someone to act on your behalf form (IR 597).

FAQs