GST (Goods and service Tax) is a broad-based 10% tax on goods and service or other items sold and consumed in Australia. But some businesses do not have to pay any GST. (e.g., many basic medical, foodstuffs, and educational services, exports), input-taxed (residential accommodation, financial services, etc.), exempt (Government charges), or outside the scope of GST.

What is GST (Goods and Services Tax)?

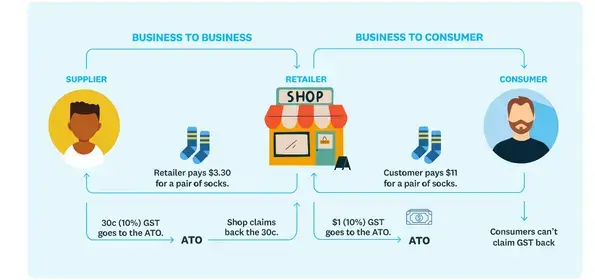

Goods and service Tax (GST) 10% is a value-added tax (VAT) added to most prices in Australia. The GST Tax is paid by consumers, but it is remitted to the Government by businesses selling the services.

Businesses or enterprises with a turnover of more than $150,000 must apply to register for GST. But if the turnover is less than the threshold $150,000, they can choose to register for GTS or not.

Generally an organization that registers for GST must stay registered for at least 12 months. Once your threshold reaches $150,000, you must apply for GST within 21 Days.

How can GST affect my business?

Business or enterprise must register for GST, if the threshold is reached and collect the GST. This mean:

- You need to add GST in your price.

- You’ll need to send that GST to ATO (Australian Taxation Office).

- You can also claim back any GST that you’re charged on business supplies and expenses.

How to Register for GST?

To register for GST, you need to complete an application on the Business portal. Before registering for GST, your business must have ABN. You can also apply for ABN. Please see our step-by-step on How to register for GST?

How much is GST?

10% is the GST rate. It applies to the goods and services consumed in Australia. It’s worth checking regularly with ATO (Australian Taxation Office).

Also read about: Australia Tourist Refund Scheme

Calculate GST

You can use GST Calculator on our site to calculate GST and work out how much GST is included in a sale.

GST free sales

Some types of products can be sold without adding any GST Tax.

- Financial products and services.

- Some education courses and resources.

- Staple foods such as fruit and vegetables, meat, most dairy, spices, and sauces.

How does GST work?

The GST to be paid by the consumers, rather than by the business involved in its supply. Take this example:

GST on Imports

You’ll have to pay the GST on the on Imported Goods. It’s added to the price paid for goods and shipping costs, and you’ve to pay before releasing them from the customs. You can claim back when you submit a GST return back.

GST-registered businesses don’t have to pay GST on services from overseas suppliers.

GST on Exports

You don’t have to charge GST Tax on exports as goods leave Australia within 60 Days of you receiving payment or issuing an invoice, whichever comes first.

Frequently Asked Questions

What does GST stand for?

GST Stands for Goods and Services Tax. Tax added in Goods and services consumed in Australia.

How do I register for GST?

You can register through the online ATO Portal. You can pay by debit card, bank transfer or in person at Australia Post.

Conclusion

In this article you’ve read about the ‘What is GST’. But this guide is only provided for information purposes. You should consult with your professional advisors for advice directly related to your business.