Tourists departing from Australia can get their GST (Good and Services Tax) under the Australia tourist refund scheme (TRS), administered by the Department of Home Affairs and its operational arm the ABF (Australian Border Force).

What is the Australia Tourist Refund Scheme (TRS)?

The Australia tourist refund scheme (TRS) was introduced on July 1, 2000, and allows Australian travelers to get back 10% GST on the price paid for anything bought in Australia. The scheme applies to goods purchased including GST or WET.

Note: The scheme does not apply on accommodation, and the goods purchased without GST.

What purchases are eligible for the GST refund?

The TRS covers a range of goods and services in Australia, but there are some criteria you need to meet.

- Tourists must purchase goods and services more than AUD$300.

- Tourists must have paid by themselves.

- The purchase must be made no more than 60 days.

Note: Online transactions are also eligible for claim, just need to download an invoice.

For calculate your GST you paid on Goods and Services, Visit our GST Calculator

What can’t you claim under the Tourist Refund Scheme?

You can’t claim GST if you purchase goods and services from not registered businesses.

- Dangerous goods.

- Tobacco and tobacco products.

- Gift Cards.

- Medication and medical aids.

The Australian Border Force website has an up to date list.

Also read about: Lodging a Tax Return in Australia

How to claim the Australian TRS refund?

- Spend at least AUD$300 in total on Goods and Services from a merchant with the same ABN (Australian Business Number).

- You can claim your GST within 60 days after purchasing goods and services.

- Travellers must have original tax invoice/s of the goods.

- Travellers must have Invoice (in English), passport, goods, and boarding pass to the TRS facility when departing Australia.

- Make a claim at the Tourist Refund Scheme (TRS) facility at an airport ,at least 30 minutes prior to the scheduled departure time or 60 minutes.

Note: Residents of Australia’s external territories, such as Christmas Island, Norfolk Island and the Cocos (Keeling) Islands, can also get a GST refund.

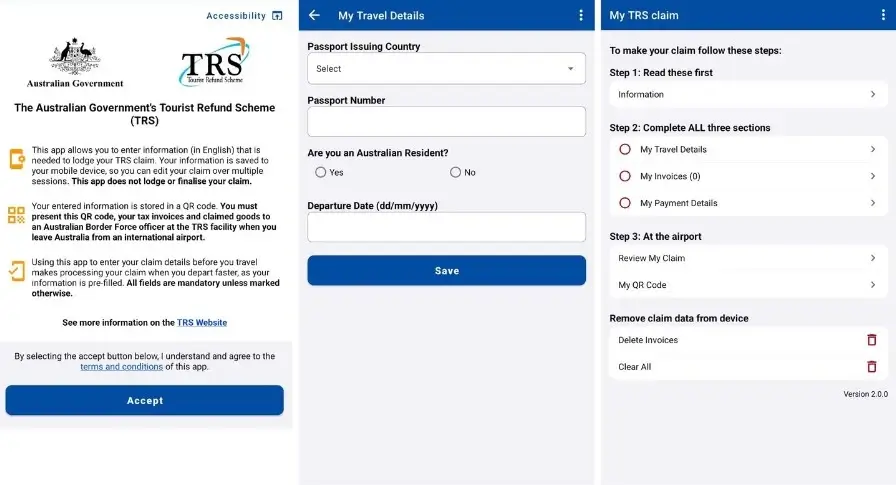

How to speed up TRS claims?

To speed in your claim you can use the online TRS Web portal or use TRS application on your iPhone or Android mobile phone.

You’ll need to enter the same information as on the paper form and you’ll get a QR code which can quickly scan at the TRS office to process your claim. There’s a separate line for tourists who’ve already used the web portal and application and have their QR code.

Summing up

Australia Tourist Refund Scheme allows tourists to claim a refund on GST. But your purchases must meet criteria, you can submit a claim – and pocket some savings towards your getaway.