Registering for GST in Australia is quite easy via online Business Portal. Not every business and enterprise needs to register for GST. But a penalty will be applied when you fail to apply when required to do so. When you’re eligible for GST, you’ve to apply within 21 Days.

Before registering for Standard GST you need to have an ABN (Australian business number). You can get an ABN when you first register your business name or at a later time. You must apply for the GST, even if you’re operating two businesses. You can also cancel the GST, if you are no longer required to be registered.

Depending on Business activities, foreign residents also need to register standard GST or simplified GST. For simplified GST they have to apply proof-of-identity requirements.

For calculate your GST, visit our GST Calculator

When do you need to Register for GST?

- When your business has turnover (gross income from all businesses minus GST) of $75,000 or more (the GST threshold).

- When you start a new business and enterprise, and you think you’ll reach the (GST threshold or more) in the first year.

- If your non-profit organisation has a GST turnover of $150,000 per year or more

- If you’ve a enterprise and reached the GST threshold.

- Taxi drivers and ride sharing drivers regardless of your GST turnover – you both have to register for GST.

- If you want fuel credit to your enterprise.

Registering for GST is optional, if your business or enterprise does not fit in these categories. If you choose to register, generally you must stay registered for at least 12 months.

Also read about: What is GST?

How to Register for GST?

If you’ve ABN (Australian business number) so, you just need to follow the following steps.

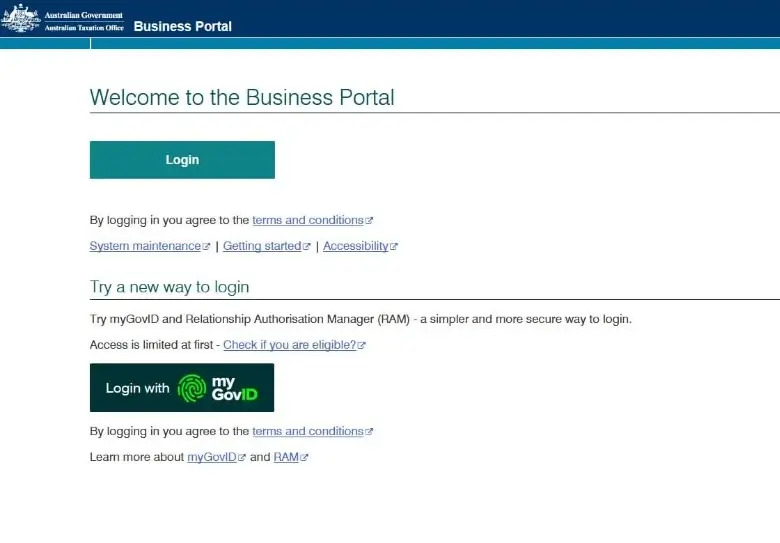

Login to ATO Business Portal

You can access the business portal using your AUSKey or ABN. However myGovID and Relationship Authorisation Manager (RAM) will replace AUSkey and Manage ABN Connections in March 2020.

Manage ABN permits you to access the government online business services using your myGov login. It’s a secure, more reliable login alternative to AUSKey that can be used on any smart device.

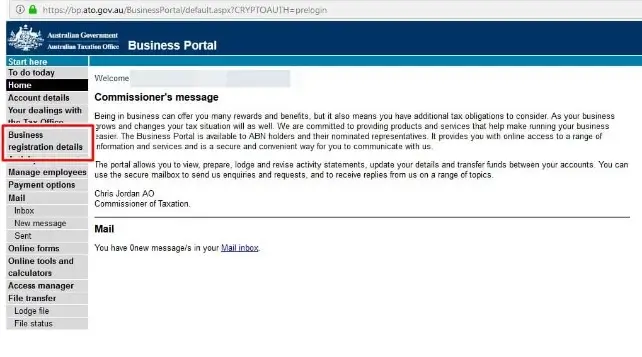

Go to Business Registration details in the menu

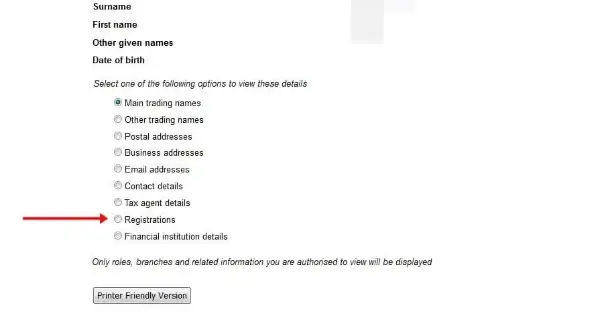

Select the Registrations Radio Button, then select next

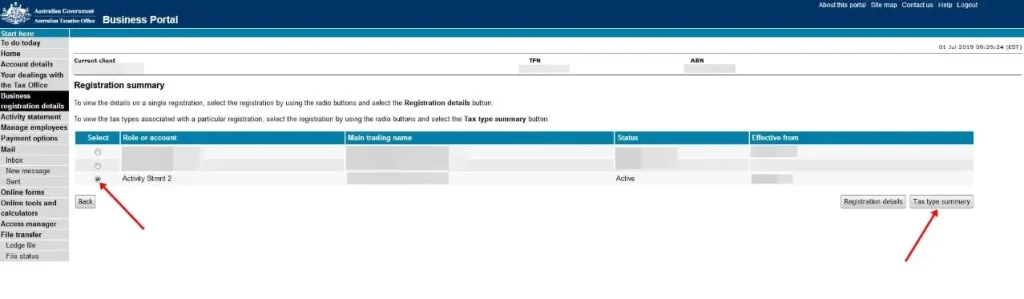

Select “Activity Stmnt” and select “Add Tax type”

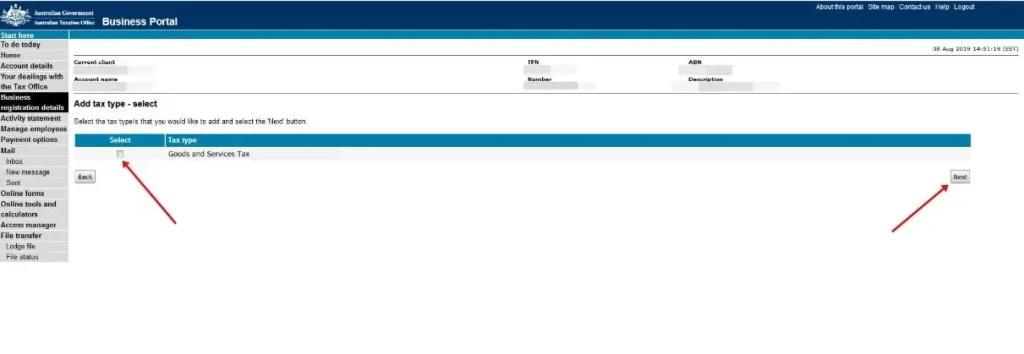

Select the Tax type to be Added (GST in this instance), then select next

Enter the Details as Prompted. That’s it!

Also read about: Cancellation of GST registration in Australia

If you don’t register

If you’re not registered for GST. Check your threshold if you reached or exceed, if reached or exceeded so, You need to register for GST within 21 Days.

If you don’t register for GST, you may have to pay GST on sales made since the date you were required to register. You may also have to pay penalties and interest.

Backdating your GST Registration

You can also apply to backdate of GST. This is limited to 4 Years. this means, unless there is fraud or evasion:

- We can’t backdate your GST registration by more than 4 years

- You are not required to be registered before that date.

GST Groups and Branches

Related entities may register as a Group in GST. An entity may register their branches separately in GST. If you’re a member of a GST group, your turnover includes the turnover of the other group members. It doesn’t include transactions between group members.

GST FAQs

Should I register for GST?

Yes, GST registering is important for everyone when they reach the turnover threshold of $75,000. But if the threshold is less than the $75,000 so, this is optional to register for it or not.

How do I register for GST as a sole trader?

If you’re a sole trader and want to register for GST. So, you must have an ABN to register through ATO Business Portal online. Please follow our steps on this page if you want to do this yourself via Business Portal.

How much does it cost to register for GST?

Registration of GST in Australia is free. However some companies charge $70+ for registration by asking the same question you would enter by yourself on the ATO Business Portal. Don’t fall for this trap and use our guide instead.

Can I charge GST if not registered?

No one can register for GST and can not charge GST to anyone. They also can not claim back the GST they pay on any invoices (but can claim the total business expense instead). Your invoice also must say no GST.